Introduction: Politics of Inward Investment

When you have a budget this big {in a small Country like Zimbabwe}, you can get what you want. In the UK at the London Stock Exchange Zanu PF {still masquerading as a government – after 43 years} set about with a slick and professional ‘Indaba’. It was impressive, all singing, all dancing performance.

They had enlisted Tom Attenborough, Head of International Business Development – Primary Markets, London Stock Exchange – to, in effect green-light their Victoria Falls Exchange {VFX} and listen to a lot of talk about changing the regulatory framework etc etc.

The Finance Minister {Mthuli Ncube} was supposed to give the “Keynote Speech” but we suspect he was arrested at Heathrow – something to do with money laundering and gold smuggling {possibly} as #GoldMafia would indicate. Maybe he had too much Gold Bullion in his luggage, thinking he could get that back to Switzerland where he lives!

Indaba Critical Review

Having said all that, the event was well scripted, well-rehearsed, with a carefully vetted audience with plenty of MBA style word-speak. {some might say “waffle”}.

Both Ambassador Colonel K Katsande {ex Military!}, and Mthuli’s “stand-in” both ironically used the word “TRANSPARENCY” in their talks – with a record of 43 years in power, and done so, with a fist of iron {in an iron glove!} aided by staggering resources built around the propaganda to 'hide' their crimes – transparency {even in terms of Investor Risk} is completely misleading!

Still with $240m to burn on the 2023 election anything is possible. Studies, data to reinforce your claims and your agenda {easily bought these days}.

Still with $240m to burn on the 2023 election anything is possible. Studies, data to reinforce your claims and your agenda {easily bought these days}.

Marketed under the banner of “”Financial Markets Indaba {their words} has the aim of mobilising investment through convening diaspora, leading global institutional investors, corporate leaders, industry experts and our team of analysts to explore sector and market trends and identify significant investment opportunities. Through thought leadership, productive exchange of ideas and sharing practices, the conference delegates and participants discuss how to integrate and align regulatory framework with new strategies, business models, financial measures, and investment decisions. FMI is a unit of Emergent Capital Management (ECM) www.ecminvest.com which is licensed and regulated by the Securities and Exchange Commission of Zimbabwe.””

- ECM must be one of the World’s only Financial Web site without a ‘secure server’ – let’s hope their casual attitude {for the sake of a few dollars for a secure server authentication certificate} towards your financial security in not reflected in their looking after your money!

The term “diaspora engagement” and “diaspora policy” were used a lot as if they could provide all the inward investment - whereas the bulk of the diaspora have, in fact fled the regime for the safety of the UK and other parts of the World - therefor ethe majority of the diaspora are against the Zanu PF regime and are not in a position to be investing - even though they would love to improve their homeland. The regimae tends to divert funds to their own benefit.

- Conference Partner: Bard Santner Markets Inc (SA)SPEAKER ON THE PANEL

- Financial Markets Indaba is Linked to; Emergent Capital Management http://ecminvest.com {a "Not secure" website} 2nd Floor, West Tower, Maude Street, Nelson Mandela Square, Sandton,2146, South Africa. Who in turn are Licenced by the Securities Commission of Zimbabwe

- Platinum Sponsors: INNSCOR Africa Ltd; CBZ; KARO Mining Holdings {Cyprus} SPEAKER

- Gold Sponsors: House of Chinhara

- Conference Sponsors: Nyaradzo Group; West Prop Holdings

Reality vs Sales Pitch

Now all their talk about improvements, better regulatory controls, better investor relations, better marketing {of Zimbabwe's Zanu PF regime}, lessons learned etc etc. Belies the fact that the Zanu PF regime has been in control of all aspects of government {and some would say that there is no division between the Zanu PF Party and all functions of government} for 43 years!! Yes 43 years in charge, every election time they make the same old promises over and over – but have never delivered!

Now that Zanu PF are spending $240m to get 5 more years of incompetence, corruption, looting and graft – enforced with a rod of iron or the gun!

The chap from the Cyprus registered Karo Mining Holdings {Bernard Pryor} briefly mention {with a sly grin} their needs for power – electricity to run their operations. So much is their need that he has signed a Memorandum of Understanding {MOU} for 300MW of Solar Power with a French Company. Forgetting to mention that that number {of MW} is the “Plate Power” potential – except when its dark, or cloudy etc. He stated that they need 70 MW – the rest would go into the “Grid” {joke}.

Which brings us to The CEO of ZIDA {Zimbabwe Investment and Development Agency} Mr Tafadzwa Chinamo. He spoke quickly about INFRASTRUCTURE {to be fair he did allude to some problems – but moved on without further explanation}.

So lets look at the Infrastructure in Zimbabwe: World Bank Assessment 2011

Zimbabwe made significant progress in infrastructure in its early period as an independent state. The country managed to put in place a national electricity network and establish regional interconnection in the power sector; to build an extensive network of roads for countrywide accessibility and integration into the regional transport corridors; to lay the water and sewerage system; and to make progress on building dams and tapping the significant irrigation potential.

Unfortunately, at present the cross-cutting issue across all these sectors is Zimbabwe’s inability to maintain and rehabilitate the existing infrastructure since the country became immersed in economic and political turmoil in the late 1990s.

Neglect of all sectors due to the crisis has resulted in a generalized lack of new investment (in the power and water sectors in particular), and the accumulation of a huge rehabilitation agenda. Quality of service has declined across the board. The power system has become unjustifiably costly, inefficient, and unreliable.

The condition of roads has deteriorated to the point that Zimbabwe became a bottleneck on the North–South transport corridor. Rural connectivity hardly exists. Failure to treat potable water, along with the deterioration of the water, sanitation, and garbage disposal systems, was responsible for the spread of cholera in 2008 {see section regarding Water and Sewage next}. By 2010 cholera affected most areas of the country and posed a health threat to neighboring countries.

- Looking ahead, Zimbabwe faces a number of important infrastructure challenges. Zimbabwe’s most pressing challenges lie in the power and water sectors. Inefficient and unreliable power supply poses major risks to the economy, while the maintenance and upgrading of existing power infrastructure no longer looks to be affordable. At the same time, overhauling the water and sewerage system is imperative for curbing the public health crisis.

- With respect to regional integration, Zimbabwe must improve the condition of the international road corridors that pass through its territory, along with reducing transit costs and transit time, to gain the most from its strategic location in the heart of the southern Africa region and its proximity to the region’s largest economy and trading partner: South Africa.

- Addressing Zimbabwe’s infrastructure challenges will require sustained expenditure of almost $2 billion per year over the next decade, with heavy emphasis on rehabilitation; more than half is needed for the power sector. This overall level of spending would represent 46 percent of gross domestic product (GDP),1 one of the largest infrastructure burdens for any African country. Investment alone would absorb 31 percent of GDP, roughly twice the unprecedented infrastructure investment effort made by China during the 2000s. Even if measured in terms of average pre-crisis GDP, the overall infrastructure spending needs would absorb some 30 percent of GDP.

Oh dear – what progress has been made over the intervening 12 years?

Well this study in April 2020 {3 years ago and 9 years after the World Bank’s assessment is not encouraging.

Problematic Infrastructure Factors Affecting Development in the 21st Century for Zimbabwe *Wellington G. Bonga1 and Rodrick Sithole2 1Department of Banking and Finance, Great Zimbabwe University, Zimbabwe. 2Department of Banking, National University of Science and Technology, Zimbabwe.

The study identified and discussed five problematic infrastructure factors that hinders development. Addressing of the factors will place the country on a better position for recovery using a better recovery pace. The study utilized the Network Theory to support its argument. The identified factors are power cuts and shortages, poor road infrastructure, inefficient rail network within the country, water shortages and poor transport infrastructure for access to ports.

Power cuts and shortages

Availability of power to every citizen is a basic requirement. Rural electrification has been a mantra for both politicians and social and economic development seekers in many developing nations. Low priced power can contribute significantly to the efficient and effective functioning of the Zimbabwe economy (AfDB, 2019)[1]. There has been a growing outcry of power cuts and shortages for the past years, and this has affected the smooth flow of business. The power system has become unjustifiably costly, inefficient, and unreliable (Pushak and Briceño-Garmendia, 2011), and this remains the case to date. Zimbabwe’s power infrastructure is starved of new investments. Alternatives to electric power in form of generators gained momentum, but due to shortages and high costs of fuel the option flopped. Energy crisis has been worsening over the years in the country, and to solve such there has been load shedding taking place to ration the little energy in the country (Bonga and Chirowa, 2014). To operate efficiently businesses and factories need electricity supplies that are free of interruptions and shortages (AfDB, 2019). Zimbabwe obtains electricity energy from its five internal sources and imports as well. Kariba power station produces the highest level followed by Hwange power station with less than half while some small amounts comes from Bulawayo, Harare and Munyati stations. The power stations comprise of aging equipment, hence imported electricity has a significant fraction to cover up for the energy deficit in the country (Bonga and Chirowa, 2014). Power cuts and shortages have affected business operations and planning. Heavy industries have scaled down heavily are far operating below capacity. The price of power has also soared due to rationing leading to high cost of doing business. The alternatives to power are equally unattainable.

Full PDF in Appendix

So what is the situation with Electricity in 2023? An Article 21st March 2023 is up to the minute - but depressing

https://theworld.org/stories/2023-03-21/zimbabwe-struggles-keep-power

Businessman Kizito Tinarwo said he has many orders for products from his small steel and aluminum factory, but power blackouts have hit production hard in Zimbabwe.

He uses a gasoline-powered generator when the power goes out, but this is expensive and has its limits.

“It cuts into profits because we add to our costs of doing business,” he said. “The generator cannot run forever; it has its prescribed running hours. We switch it on and off. In the process, our lead times are affected.”

This has been the case since he started his business about four years ago. But the latest outages have been longer — sometimes lasting 19 hours a day.

Along the border between Zimbabwe and Zambia sits Lake Kariba, where low water levels have interrupted power supply to both countries. The world’s largest manmade lake by volume is on the Zambezi River, with hydroelectric power generators on both sides. Zimbabwe gets 70% of its power from Lake Kariba. But plunging water levels have worsened a yearslong power crisis — profoundly impacting the economy.

And Tinarwo is not the only one impacted by the power outages. Zimbabwe’s many minerals include platinum, gold, chrome and lithium, and mining accounts for the bulk of Zimbabwe’s export earnings.

Collin Chibafa, president of the Zimbabwe Chamber of Mines, said some 88% of the country's mines experience outages of as long as 12 hours.

He said some mining companies are now taking matters into their own hands by building solar plants.

“Obviously, those only work maybe four or five hours a day [that] we get peak production. Some of our members run diesel generators, but that's an expensive and the least-viable option. If you have people underground, they need ventilation, they need oxygen, it's really crucial that you can safely get people up from underground,” he said.

Households are not spared the inconvenience as power goes without prior notice. People with enough discretionary income may use generators, solar energy and inverters — but these options are beyond reach for the majority. Gas for cooking has become the go-to option for those who can afford it. For those who can’t, charcoal is readily available and affordable. And the sprawling, open-air market in Mbare, Harare's oldest working-class neighborhood, is the place to buy it.

Nyarai Mupesa, who has sold charcoal there for the past five years, said business is good whenever there is no power.

“When there are power cuts, sales are good, people need charcoal for cooking and to keep warm,” she said.

The problem is that charcoal, and the other low-cost option, kerosene, both contribute to deforestation and pollution. Chopping and burning trees for charcoal is illegal in Zimbabwe. But that has not stopped the practice. And most of the charcoal sold at Mbare is imported from Mozambique because, according to Mupesa, it is better quality.

“You pay the required duties and are issued with a receipt that enables you to get to Harare with your charcoal,” she explained.

Besides the hydroelectric plant on Lake Kariba, Zimbabwe's other main power source, the Hwange thermal power station is old and breaks down frequently. New units at the power plant are set to start generating power soon. But even if it and Kariba operate at capacity, they cannot meet Zimbabwe's power needs.

Energy expert {??} Victor Utedzi runs a solar farm.

He sees renewable energy as a solution to Zimbabwe’s power problems. So does the government. In a bid to attract more local and private investors to set up solar and hydropower plants to sell to the national grid or direct to some consumers, the government recently announced new policies.

“The government has given a guarantee that if the utility is unable to pay, the government will step in and make the payment. The government has also opened the space even further; they allow you to sell directly to some of the largest industrial and commercial clients in the country,” Utedzi said.

The government also imports power from neighboring countries but that doesn’t always work due to currency shortages.

Building another hydropower station upstream from Kariba is seen as the best hope for solving Zimbabwe's power woes. But two decades after it was proposed, no action has been taken.

Until it becomes a reality, the rolling blackouts will continue.

Comment:

So, the same regime has been in power {excuse the pun} for 43 years and still these problems persist! What is to blame? Who is to blame?

Empty and grandiose promises are made every 5 years for the election cycle - but as can be seen from the evidence {both anecdotal and peer reviewed} nothing happens. The power outages are just getting worse! The regime is to blame.

The same regime that is seeking inward investment at the Indaba over 20th and 21st April 2023

Caveat Emptor: Let the buyer {investor} beware!! This old adage could not be more true in Zimbabwe after 43 years of neglected infrastructure. #GoldMafia has exposed the reality of “Business in Zimbabwe” and its Rotten to the Core!

Started October 2019 and running to the year 2030: EXECUTIVE SUMMARY

>The Zimbabwe Multi-Donor Trust Fund was established in 2010 as an emergency response to a severe humanitarian crisis that manifested itself in the deadly cholera epidemic that engulfed the country in 2008/9.

The outbreak claimed more than 4,000 lives and affected more than 100,000 people. The ZimFund Donor countries responded to the outbreak of cholera by mobilizing funds for the rehabilitation of water supply and sanitation infrastructure complimented with the rehabilitation of power infrastructure. The African Development Bank (the Bank) was requested by donors and accepted to administer the Fund in accordance with the Bank’s rules and procedures and an Operational Manual that was prepared and agreed to between the Donors, the Bank and the Government of Zimbabwe (GoZ).

The size of ZimFund was determined by development partners’ willingness to contribute to it over time. By 31 October 2016, ZimFund Donor’s contributions had reached an amount of US$145.8 million, representing full settlement of donor’s commitments to the Fund. In support of a functioning infrastructure development and its contribution to the economic recovery process and people’s livelihood, the Bank approved the second phase of the Urgent Water Supply and Sanitation Rehabilitation (UWSSRP) on 7 October 2013 with a total estimated cost of US$35.99 million. However as funds were not fully available at the time of presentation of the project, only an amount of US$19.84 million was approved to cover part of the cost of the project.

The Board was informed at the time that management would come back for the approval of the remaining amount once resources were mobilized and secured from ZimFund partners. The presentation of the stage 2 financing which was the remaining amount estimated at US$16.15 million was approved on 30/09/2015. The result of the UWSSRPII project was found to be inadequate in some areas due to the unavailability of funding needed to address additional activities that surfaced during the project implementation and this had an effect on the expected outcomes and results. As a result, the POC approved USD 0.81 million to fund additional scope (Consolidation works) that is to be funded from the savings of ZimFund phase I projects. Plans have been made to implement the works for Mutare, Masvingo, Chegutu and Kwekwe.

The designs and specifications have already been completed and the preparation of the tender documents is underway. Furthermore, USD 1.70 million has been secured from interest and income earned on investment on the ZimFund accounts. Out of this amount, USD 0.94 million has been approved by the POC to finance additional consolidation works bringing the total amount for Water and Sanitation Consolidation works to USD 1.75 Million. The consolidation works will be implemented in 5 local authorities:-

- Chitungwiza, An electro mechanical hardware intervention is proposed to address the effluent pump stations that constantly breakdown.

- Chegutu, The poor water and sewerage reticulation systems will be reinforced with pipe replacements and upgrades. The booster pumping stations in the water network will also be upgraded.

- Kwekwe, The water treatment works isolation valves will be rehabilitated and replaced.

- Masvingo, a clear water pumping gear will be supplied to improve redundancy. Pipes will also be supplied to reinforce the poor water reticulation network in some high density areas. The high power consumption at the water and wastewater treatment plants in Masvingo will also be solved by power factor correction equipment to be supplied.

- Mutare’s, Dangamvura which still face water challenges because of incomplete supply pipeline, will be connected to the ZimFund rehabilitated Chikanga tank.

The processing and implementation of the consolidation project will be guided by the Operations Manual developed for ZimFund. The implementation arrangement will remain the same as those of phase II and will receive regular follow up and supervision from ZimFund Management Unit (MMU) and other GOZ structures. The POC will continue to provide the policy and strategic guidance. It is highly recommended that if the Project goals and objectives are to be met, the Project must be completed as per the original plan.

The implementation of the consolidation works will result in the Project being able to fully achieve its objectives in the identified beneficiary local authorities. The additional resources being requested will make it possible for the Project to be completed as planned. It is against this background that POC approved the consolidation financing totaling USD 1.75 (USD0.81 million and USD0.94 million on 17 March 2017 and 15 February 2018 respectively) to implement these works and now the Bank is being requested to approve the same amount for the consolidation works in line with the ZimFund implementation agreement which requires the approval by the POC and the Bank.

Let us remember that all these financing problems and shenanigans were all under the Zanu PF regime's ambit - they were in charge. Additionally, some of the objectives set in the initial 2010 reactions to the Cholera and Typhoid outbreaks are still to be implimented - until 2030 - a seemingly inordinate amount of time to execute? Added to other Infrastructure issues raised in the World Bank Assesment in 2011, this lack of prioritisation of these key issues cannot be ignored.

Typhoid and Cholera will return, as the Infrastructure programme has not been completed. At the same time as Harare expands, little provision to enlarge this programme has been addressed by the regime.

The Borgen Project report in 2016 has shown little improvements. Even in September 2021 the availability of potable {drinking} water was a crisis {again} in Harare, the capital of Zimbabwe. Human Rights Watch did a report on the ground. Again all these crises are under the eye of the Zanu PF regime - the question is- What are Zanu PF doing as a government? The issue of Infrastructure is a key responsibility of government.

The ZIDA Act is claimed to be the answer, but since its introduction in February 2020 little benefits for the general population have been observed. Indeed the candid Blog on 9th March 2020 made the following pointers.

"The ZIDA Act is an important but not the only step to attract foreign investment in Zimbabwe. Businesses will not invest in Zimbabwe solely because of the promulgation of the ZIDA Act. The government needs to address the overall investment governance framework, and restore business confidence in Zimbabwe. It should tackle economic and political challenges like currency or cash crisis, access to finance, costs of doing business, corruption, respect of rule of law, protect property rights, remove unnecessary administrative burdens to investment, and address a combination of factors contributing to the deterioration of the investment climate in Zimbabwe. The government of Zimbabwe needs to understand the expectations of the investors (beyond traditional motivations) and today’s business models then develop its investment policy environment accordingly."

So the Reserve Bank of Zimbabwe – looking after your Investment

#GoldMafia from Al Jazeera

https://www.newsday.co.zw/local-news/article/200010416/gold-mafia-rbz-under-sharp-scrutiny

20th April 2023

THE Reserve Bank of Zimbabwe (RBZ) has come under renewed pressure to deal with allegations of gold smuggling and money laundering after a leading think-tank said the central bank’s operations should be audited following a damning exposé by an international broadcaster.

THE Reserve Bank of Zimbabwe (RBZ) has come under renewed pressure to deal with allegations of gold smuggling and money laundering after a leading think-tank said the central bank’s operations should be audited following a damning exposé by an international broadcaster.

Zimbabwe was placed at the centre of gold smuggling and money laundering activities by syndicates operating in southern Africa following an investigation by Qatar-based Al Jazeera television network.

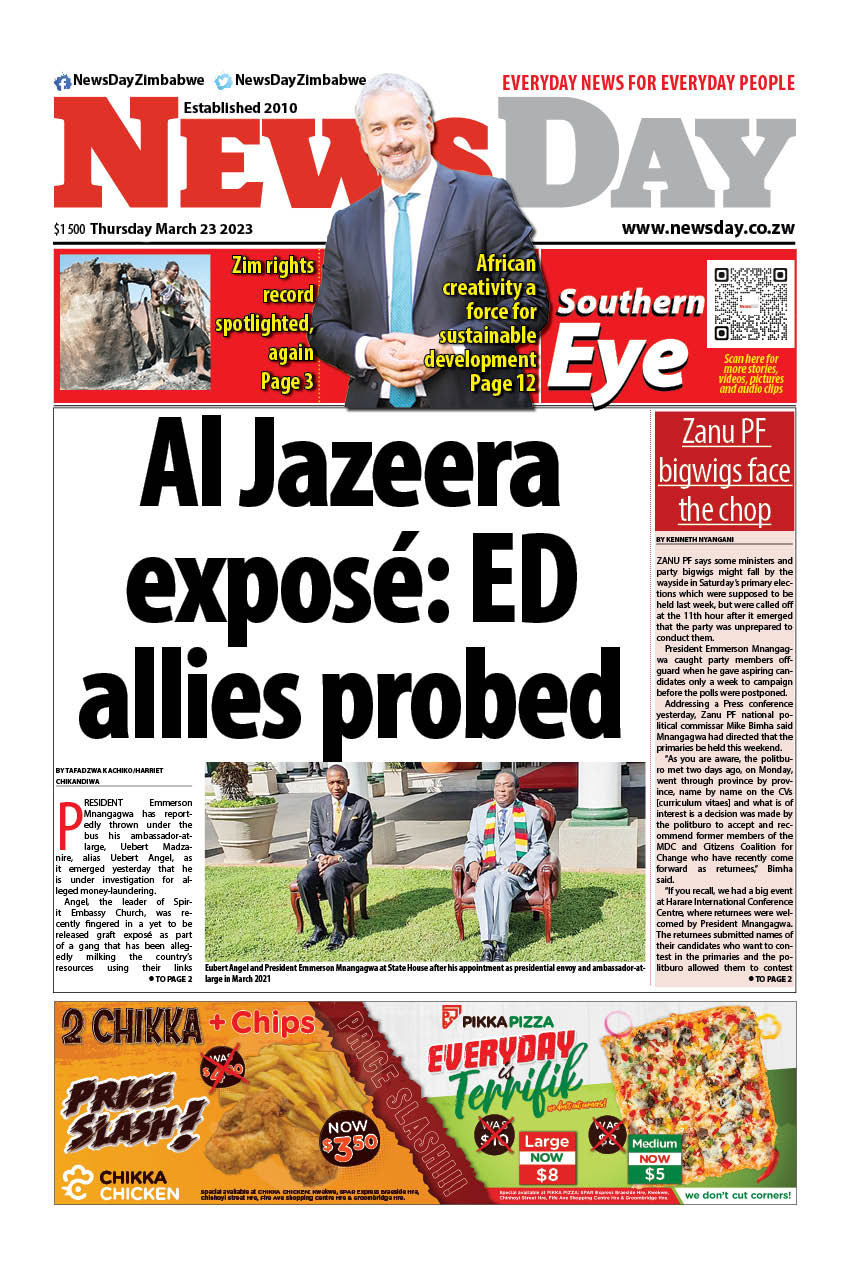

The documentary, aired between March and last week {14th April 2023}, was centred on a secret recording of President Emmerson Mnangagwa’s ambassador-at-large Uebert Angel — born Uebert Mudzanire — and his associates promising to help undercover Al Jazeera journalists launder US$1,2 billion in dirty money.

In an analysis of revelations made in the four-part documentary titled the Gold Mafia, legal think-tank Veritas said there was an urgent need to audit RBZ operations.

Government has since said it would investigate all individuals implicated in the documentary, while the Financial Intelligence Unit (FIU) froze assets of Civil Aviation Authority of Zimbabwe security official Cleopas Chidodo, Aurex Holdings official David Chirozvi and former Fidelity Printers and Refiners senior executives Mehlululi Dube and Fredrick Kunaka.

Chidodo, Chirozvi, Dube and Kunaka were secretly recorded by the undercover journalists speaking about their alleged roles in facilitating money laundering and smuggling activities.

Aurex and Fidelity are both RBZ subsidiaries.

The RBZ also froze the accounts of some of the people named in the documentary such as Ewan McMillan, Kamlesh Pattni, Angel and Simon Rudland.

Veritas, however, said a forensic assessment of the central bank was necessary following the claims made by people that were employed by its subsidiaries and some of the suspected money laundering and smuggling kingpins.

“The Reserve Bank is a vital cog in the country’s economy and it is essential for it to maintain a spotless reputation for competence, fiscal responsibility and probity,” Veritas said.

“The Al Jazeera series, coming on top of the bank’s illegal quasi-fiscal activities, have tarnished its reputation and sown suspicion within financial markets, multilateral financial institutions and the general Zimbabwean public.

“In the interests of transparency and accountability an investigation should be undertaken to ascertain precisely what the bank and its subsidiary companies have been and are doing and whether their activities have been lawful.”

According to Veritas, the RBZ Act gives the central bank wide powers to buy, sell and keep gold, hence the call for a forensic audit.

The legal think-tank gave three suggestions on how the audit could be done.

One of them is that Finance minister Mthuli Ncube could order an investigation into the central bank’s activities in terms of section 38 of the RBZ Act.

“The section gives persons conducting an investigation power to demand documents and answers from all officers, employees and agents of the bank; anyone refusing to supply such documents and answers on demand can be imprisoned for up to three months,” Veritas said.

“The Auditor-General (Mildred Chiri) could be directed to conduct a forensic audit of the bank’s financial statements and the financial statements of its subsidiaries.

“Section 309(2)(b) of the Constitution says that at the request of the government, she (Chiri) must carry out a special audit of the accounts of any statutory body or government-controlled entity.

“And section 6(1)(a) of the Audit Office Act gives her the function of auditing the accounts of public entities on behalf of the National Assembly.

“So, she could conduct a forensic audit at the direction of either a government minister or the National Assembly.”

Veritas said Mnangagwa could also appoint a commission of inquiry to investigate the activities of the bank and its subsidiaries.

One challenge, according to Veritas, of the third option was that the documentary implicated Mnangagwa himself in the illicit activities.

“The persons alleged to be carrying on this illegal trade were shown boasting of their close links to the Reserve Bank of Zimbabwe and to senior government officials, up to and including the President and his wife,” Veritas said.

“They said they had the governor of the Reserve Bank (Joh Mangudya) ‘on speed dial’ and that senior managers of Fidelity Printers and Refiners, a subsidiary of the Reserve Bank, were on their payroll to facilitate the issue of licences to buy and export gold.

“Through these links, they claimed, all the processes in their trade were made to seem above board, with legitimate paperwork to authorise their gold exports.”

According to Veritas, any audit or probe carried out in accordance with the company’s recommendations would have enough legal authority to substantiate misconduct on the side of the apex bank and supersede any right to confidentiality granted by section 60 of the RBZ Act.

The governor, however, released a statement denying any involvement by the central bank in money laundering schemes before the documentary was broadcast in full.

The governor, however, released a statement denying any involvement by the central bank in money laundering schemes before the documentary was broadcast in full.

Angel’s lawyer Lovemore Madhuku said his client only entertained the undercover journalists as part of an “intelligence operation” after he realised that they were not genuine investors. He denied allegations that he was involved in money laundering and gold smuggling.

Contacted for comment, Mangudya said the call by Veritas for a probe “are a welcome development”.

“The allegations by the Al Jazeera interviewees on which Veritas are basing their calls on are not consistent with the way gold is produced and traded in Zimbabwe,” he told NewsDay.

“The bank was not involved in illicit gold activities and has no appetite to do so. The bank has a zero tolerance to illicit trade in any commodity and money laundering. Calls by Veritas are, therefore, a welcome development.”

Ncube did not answer repeated calls to his cellphone, while Treasury spokesperson Clive Mphambela’s number was not reachable.

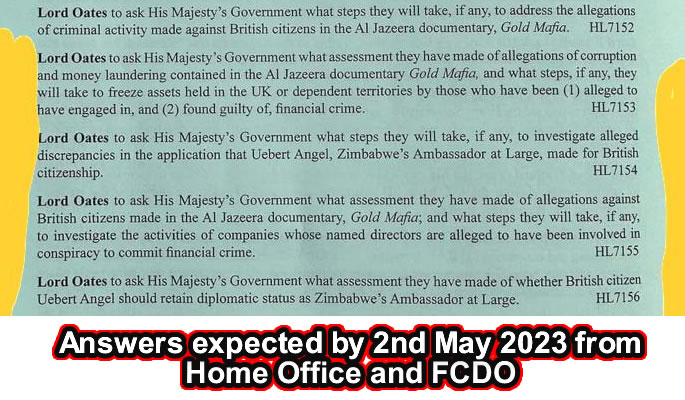

United Kingdom Member of the House of Lords Jonathan Oates tweeted: “The allegations contained in the Al Jazeera documentary, #GOLDMAFIA are very serious and as you say, they do involve allegations against British citizens. I’ve tabled questions ... to ask the government to investigate ... so that those (allegedly implicated in gold smuggling and money laundering) do not profit from those alleged crimes.”

Background from Zimbabwe News Reports

Background from Zimbabwe News Reports

https://www.newsday.co.zw/local-news/article/200009871/gold-mafia-exposes-eds-us240m-election-war-chest

7th April 2023

SELF-STYLED prophet and President Emmerson Mnangagwa’s ambassador-at-large Uebert Madzanire, aka Uebert Angel, has claimed that Mnangagwa will spend US$240 million for his re-election bid.

Appearing in the third episode of the four-part Al Jazeera documentary on gold smuggling and money laundering titled Gold Mafia: El Dorado that aired yesterday, Angel said: “His (Mnangagwa) election, I think they are spending like US$240 million and that is his money.”

Angel has appeared in all three episodes aired so far in which he was secretly recorded by Al Jazeera investigative journalists offering to use his diplomatic cover to facilitate gold smuggling and money laundering.

Zanu PF spokesperson Christopher Mutsvangwa and political commissar Mike Bimha were not answering their mobile phones despite repeated efforts.

The controversial prophet’s alleged involvement in the alleged criminal activities has triggered outrage in and outside the country, with Zimbabweans domiciled in South Africa threatening to demonstrate today at his Johannesburg church to demand authorities to act on his alleged corrupt deals.

Zimbabweans based in the United Kingdom will also on April 18 deliver a petition to the British government to freeze Angel’s assets.

In the documentary, Angel demanded US$200 000 from the Al Jazeera investigative journalists for him to organise a meeting with Mnangagwa, which he described as an “appreciation” fee.

“That guy (Mnangagwa) doesn’t take bribes, oh no he won’t. There is a big difference between appreciating somebody and bribing.

“You know at this level, people don’t bribe anybody, you get my point. He is not that kind of a person,” Angel said.

“When somebody got that money to spend on an election campaign, you give one million, it’s like a slap in the face, unless you say a thank you.”

During the undercover investigation, Angel’s personal assistant Rikki Doolan also claimed that government ministers needed to be “greased” to facilitate the deals.

“Obviously, once we get the ball rolling, there will be points and times along the way where people will need to be greased,” Doolan said.

In response to a public outcry over the Al Jazeera exposé, the Reserve Bank of Zimbabwe (RBZ)’s Financial Intelligence Unit announced on Wednesday that it had frozen assets of four officials implicated in facilitating gold smuggling.

But the decision to freeze assets belonging to Cleopas Chidodo (Civil Aviation Authority of Zimbabwe head of security, stationed at Robert Gabriel Mugabe Internal Airport), David Chirozvi (RBZ’s Aurex Jewellery head of finance), Mehluleli Dube (Fidelity Printers and Refiners gold-buying manager) and Fredrick Kunaka (Fidelity Printers and Refiners general manager) sparked outrage, with critics saying the authorities were targeting the small fish, leaving the kingpins involved in the alleged gold smuggling and money laundering scandal.

On Tuesday, government announced that it had launched a probe into the corruption allegation raised in the Al Jazeera exposé.

Zimbabwe Miners Federation president Henrietta Rushwaya and gold dealer Ewan MacMillan were also implicated in the Gold Mafia exposé.

Exiled former Cabinet minister Jonathan Moyo said Angel’s assets should also be frozen.

Exiled former Cabinet minister Jonathan Moyo said Angel’s assets should also be frozen.

“It would be unwise to go after all of these pikininis on grounds that they incriminate themselves in the documentary when everyone has seen that their handlers, the real Gold Mafia as described in the documentary, have done more and better self-incrimination, and basically nailed themselves beyond any escape,” Moyo said on Twitter.

“For example, ambassador plenipotentiary Uebert Angel said he owns and runs something called Billion Group, which facilitates gold smuggling and money laundering.

“There is no reason for not freezing the assets of the ambassador’s Billion Group, given what he says about it in the documentary!”

Centre for Natural Resource Governance director Farai Maguwu urged government to investigate “everyone” implicated in the documentary.

“First, there is need to investigate all the people who are involved, that is everybody mentioned, whether they are residents of Zimbabwe or not in Zimbabwe,” Maguwu said.

“We have international police who can assist the police to arrest whoever has been fingered in this gold looting heist. We have Uebert Angel who has been mentioned. He seemed to be one of the kingpins of the Gold Mafia, and we are not hearing anything that has been done, either to freeze his assets or to get him arrested.”

The Indaba Organisers

Financial Markets Indaba is co-hosting together with the Zimbabwe Embassy in United Kingdom the Zimbabwe Capital Markets Conference in London on 20 April at the London Stock Exchange and 21 April at the Queen Elizabeth II Conference Centre.

The aim of the Zimbabwe Capital Markets Conference is to highlight and recognise the important role played by capital markets in economic development and preservation and growth of households’ savings, as well as to focus on opportunities available in different sectors outlining the opportunities for diaspora, international investors, companies/firms to allocate capital in different asset classes. The conference serves as an opportunity to inform the diaspora and demystify complexities and myths that surround participating in financial and capital markets and in turn encourages individuals from all walks of life to invest on the local markets including stock exchanges.

Capital Markets Development in Zimbabwe

Capital markets offer investment alternatives. The number of stock exchanges on the continent has grown from five in 1989 to 28 today, with stock markets growing continuously in the number of shares listed and the traded volume. In Zimbabwe the ZSE is the backbone of the country’s capital market with a history dating back as far as 1896. It is one of the oldest and most highly diversified exchanges in Africa given listings spanning all key sectors of the economy.

Victoria Falls Stock Exchange (VFEX), a subsidiary of the Zimbabwe Stock Exchange, is a financial offshore centre that trades in foreign currency and is earmarked for the special economic zone in Victoria Falls. Zimbabwe’s capital markets continue to evolve. Consensus amongst capital markets players has it that currently the sector has an untapped potential contribution to economic growth. The market keeps transforming and building capacity to offer a wide variety of new products. Read Less

The recent establishment of the Victoria Falls Stock Exchange (VFEX) is one of the many initiatives Government is pursuing to stabilize the economy and attract foreign direct investments. There is growing activity on the VFEX with a number of companies showing interest to list on the foreign currency-denominated bourse to seek to take advantage of offshore settlement options which allow investors to efficiently repatriate their dividends. The launch of the VFEX has been a game changer and the Government expects that it will emerge as a competitive global platform to raise capital and this will transform the country’s tourism capital into an attractive Offshore Financial Services Centre.

The two-day conference program will include the following:

Day-1: Investor Day at the London Stock Exchange – VFEX listed/listing Companies will make presentations highlighting their success stories and company value proposition

Day-2: Main plenary – the main plenary will host panel discussions which will host investment firms, corporates, and senior government officials to engage with delegates and participants on the opportunities, policy, efforts to reduce risk & cost of investment and doing business

Financial Markets Indaba has the aim of mobilising investment through convening diaspora, leading global institutional investors, corporate leaders, industry experts and our team of analysts to explore sector and market trends and identify significant investment opportunities. Through thought leadership, productive exchange of ideas and sharing practices, the conference delegates and participants discuss how to integrate and align regulatory framework with new strategies, business models, financial measures, and investment decisions. FMI is a unit of Emergent Capital Management (ECM) www.ecminvest.com which is licensed and regulated by the Securities and Exchange Commission of Zimbabwe.

Appendix 1

Despite general economic decline and power supply deficiencies, infrastructure made a modest net contribution of less than half a percentage point to Zimbabwe's improved per capita growth performance in recent years. Raising the country's infrastructure endowment to that of the region's middle-income countries could boost annual growth by about 2.4 percentage points. Zimbabwe made significant progress in infrastructure in its early period as an independent state. The country managed to put in place a national electricity network and establish regional interconnection in the power sector; to build an extensive network of roads for countrywide accessibility and integration into the regional transport corridors; to lay the water and sewerage system; and to make progress on building dams and tapping the significant irrigation potential.

Unfortunately, at present the cross-cutting issue across all these sectors is Zimbabwe's inability to maintain and rehabilitate the existing infrastructure since the country became immersed in economic and political turmoil in the late 1990s. Neglect of all sectors due to the crisis has resulted in a generalized lack of new investment (in the power and water sectors in particular), and the accumulation of a huge rehabilitation agenda. Quality of service has declined across the board. The power system has become unjustifiably costly, inefficient, and unreliable.

The condition of roads has deteriorated to the point that Zimbabwe became a bottleneck on the North-South transport corridor. Rural connectivity hardly exists. Failure to treat potable water, along with the deterioration of the water, sanitation, and garbage disposal systems, was responsible for the spread of cholera in 2008. By 2010 cholera affected most areas of the country and posed a health threat to neighboring countries. Looking ahead, Zimbabwe faces a number of important infrastructure challenges. Zimbabwe's most pressing challenges lie in the power and water sectors. Inefficient and unreliable power supply poses major risks to the economy, while the maintenance and upgrading of existing power infrastructure no longer looks to be affordable. At the same time, overhauling the water and sewerage system is imperative for curbing the public health crisis.

Citation: “Pushak, Nataliya; Briceño-Garmendia, Cecilia M.. 2011. Zimbabwe's Infrastructure: A Continental Perspective. Africa Infrastructure Country Diagnostic;. © World Bank, Washington, DC. http://hdl.handle.net/10986/27258 License: CC BY 3.0 IGO.”

Full text:

https://openknowledge.worldbank.org/server/api/core/bitstreams/17fa0f3e-1dc5-51c0-888c-39337d4897d2/content

Appendix 2

Problematic Infrastructure Factors Affecting Development in the 21st Century for Zimbabwe April 2020

Authors: Bonga Wellington Garikai Dynamic Research Review Rodrick Sithole University of Zimbabwe

[1] Mthuli was here!!